Clark Wealth Partners Fundamentals Explained

Our Clark Wealth Partners Diaries

Table of ContentsThe Of Clark Wealth PartnersThe 8-Second Trick For Clark Wealth PartnersSee This Report about Clark Wealth PartnersThe Only Guide for Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.Not known Facts About Clark Wealth PartnersClark Wealth Partners Fundamentals Explained

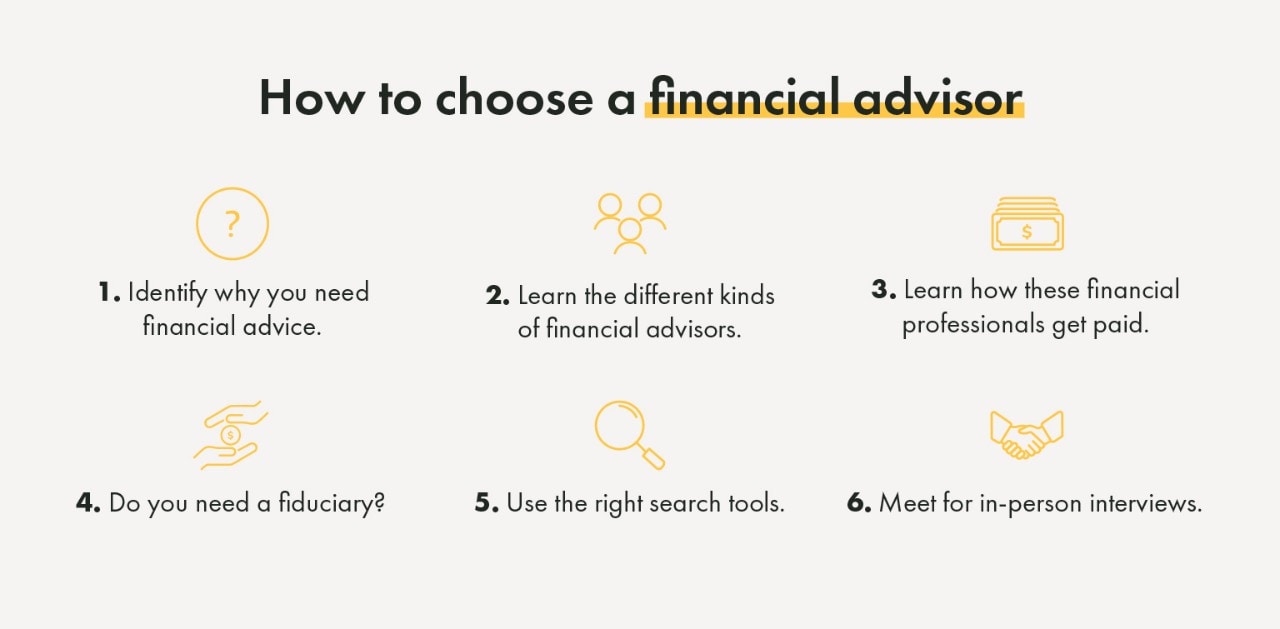

These are professionals who give financial investment advice and are signed up with the SEC or their state's safety and securities regulator. Financial advisors can additionally specialize, such as in pupil fundings, senior demands, taxes, insurance and other facets of your financial resources.Only economic experts whose classification needs a fiduciary dutylike certified monetary coordinators, for instancecan say the exact same. This difference likewise means that fiduciary and economic consultant fee frameworks vary as well.

The Buzz on Clark Wealth Partners

If they are fee-only, they're a lot more likely to be a fiduciary. If they're commission-only or fee-based (meaning they're paid through a combination of fees and commissions), they might not be. Lots of qualifications and classifications require a fiduciary responsibility. You can inspect to see if the expert is signed up with the SEC.

Picking a fiduciary will certainly ensure you aren't guided towards specific investments because of the compensation they use - financial company st louis. With whole lots of cash on the line, you might desire a monetary expert that is lawfully bound to use those funds thoroughly and only in your finest rate of interests. Non-fiduciaries may recommend investment products that are best for their wallets and not your investing objectives

Excitement About Clark Wealth Partners

Learn more now on just how to maintain your life and cost savings in equilibrium. Rise in savings the typical home saw that functioned with a monetary consultant for 15 years or even more compared to a similar family without an economic advisor. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "More on the Worth of Financial Advisors," CIRANO Task Reports 2020rp-04, CIRANO.

Financial suggestions can be beneficial at transforming points in your life. Like when you're beginning a family members, being retrenched, preparing for retirement or managing an inheritance. When you consult with an advisor for the very first time, exercise what you desire to obtain from the recommendations. Prior to they make any type of suggestions, a consultant ought to take the time to review what is necessary to you.

Fascination About Clark Wealth Partners

Once you have actually concurred to go in advance, your financial advisor will prepare a financial strategy for you. You should always really feel comfortable with your advisor and their advice.

Urge that you are notified of all purchases, and that you obtain all communication pertaining to the account. Your consultant may recommend a managed optional account (MDA) as a method of managing your investments. This includes authorizing an arrangement (MDA contract) so they can buy or offer investments without needing to examine with you.

The Clark Wealth Partners Ideas

To protect your money: Don't provide your consultant power of lawyer. Firmly insist all document about your financial investments are sent to you, not just your advisor.

If you're moving to Recommended Site a brand-new consultant, you'll need to organize to move your monetary documents to them. If you need assistance, ask your advisor to explain the process.

will retire over the following years. To load their shoes, the nation will require greater than 100,000 brand-new financial consultants to get in the industry. In their day-to-day job, financial advisors take care of both technical and creative tasks. United State News and World Report rated the function amongst the leading 20 Ideal Organization Jobs.

What Does Clark Wealth Partners Mean?

Aiding people attain their economic goals is an economic advisor's primary function. However they are likewise a small company owner, and a portion of their time is dedicated to managing their branch workplace. As the leader of their practice, Edward Jones economic experts need the management skills to hire and handle personnel, as well as the service acumen to produce and carry out a service method.

Financial consultants spend time each day enjoying or checking out market news on tv, online, or in profession magazines. Financial consultants with Edward Jones have the advantage of office research teams that assist them stay up to day on supply suggestions, common fund monitoring, and a lot more. Investing is not a "set it and neglect it" task.

Financial experts ought to arrange time each week to satisfy new individuals and catch up with the people in their round. Edward Jones economic consultants are lucky the home workplace does the hefty lifting for them.

The 10-Second Trick For Clark Wealth Partners

Continuing education and learning is a needed component of keeping a monetary expert permit (financial advisors illinois). Edward Jones economic experts are urged to go after additional training to broaden their understanding and skills. Commitment to education secured Edward Jones the No. 17 spot on the 2024 Educating pinnacle Awards listing by Training publication. It's also a great concept for financial consultants to attend market meetings.